Financial Documents

A budget for each special district is required to be submitted to the Division of Local Government on an annual basis. The budget must contain revenues, expenditures, and fund balances. Each budget must also contain a message of significant budget issues for the year, the basis of accounting, and any leases that the district is involved in. A draft budget must be presented to the board of directors by October 15th. A hearing is set for public comment thereafter. The budget document must then be adopted by December 31st (Dec 15th if levying property taxes) and submitted to the Division of Local Government by January 31st of the budget year. Special district budgets are available for review at the office of the special district, or at the Division of Local Government’s Denver office.

Link to DLG website – For comprehensive documentation, please visit DOLA's website and enter the District's Name in the "Local Government Name" box: https://dola.colorado.gov/dlg_lgis_ui_pu/

District No. 1

General Fund: $1,220,572.00

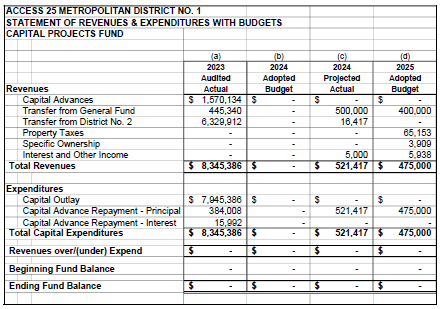

Capital Projects Fund: $475,000.00

District No. 2

Mill Levy: 38.991

General Fund: $549,634.00

Debt Serivce Fund: $723,675.00

District No. 3

Mill Levy: 41.011 mills

General Fund: $3,495.00

District No. 4

Mill Levy: 39.223

General Fund: $9,267.00

District No. 5

Mill Levy: 38.025 mills

General Fund: $339.00

District No. 6

Mill Levy: 38.015

General Fund: $507.00

A Budget Amendment (BA) is the mechanism used to revise the working budget to reflect changes that occur throughout the fiscal year. Once the working budget is completed, it can only be changed by Budget Amendment. Budget amendments are occasionally necessary and should be filed with the Division of Local Government (DLG) when adopted by a local government.

Link to DLG website – For comprehensive documentation, please visit DOLA's website and enter the District's Name in the "Local Government Name" box: https://dola.colorado.gov/dlg_lgis_ui_pu/

An annual audit of the financial affairs of the district must be completed by every District by June 30 and filed with the Office of the State Auditor by July 31.

Access 25 No 2 FINAL FS 8.30.2024 - FInal.pdfA district that has annual revenues or expenditures of less than $750,000 may apply to the Office of the State Auditor for an exemption from audit. The exemption is not automatic, it must be granted, and the request must be filed by March 31.

Access 25 No. 3 - 2024 Audit Exemption.pdfAccess 25 No. 4- 2024 Audit Exemption.pdfAccess 25 No. 5- 2024 Audit Exemption.pdfAccess 25 No. 6- 2024 Audit Exemption.pdf